The International Asteroid Warning Network Initiated a Campaign to Monitor 3I/ATLAS - Avi Loeb – Medium

1459 articles found

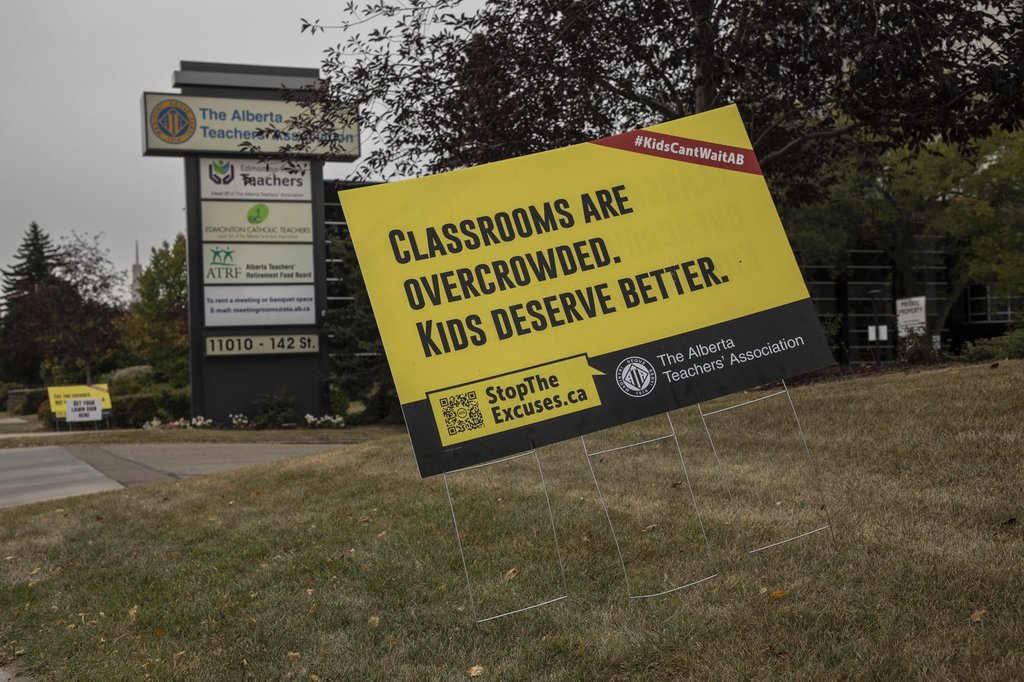

The B.C. General Employees Union has once again escalated job action. The union says that all remaining members from the BC Wildfire Service and the B.C. Ministry of Forests have joined the two-month-old strike. More than 25,000 people across B.C. are now on the picket lines. Non-binding mediation began on Saturday between the B.C. government and the union with mediators Vince Ready and Amanda Rogers. The union says that essential services were proactively negotiated and remain in place to ensure public safety. The union has more than 95,000 members in 550 bargaining units with people working in areas including health care, community social services, education, highways maintenance, casinos, credit unions, municipalities and regional districts.

Vehicles / 16 + years old "1983 Dodge van" 4 speed $1,600.00 Login to Email Seller 1983 Dodge van with 318ci motor, 4 speed overdrive transmission. Van is low milage, rusty, & has not run in about 4 year.. Great parts van or 4 speed small block pakage for future project!!! Located out of Oliver $1,600 Firm. (250)-four9eight-010seven Contact Seller Name:cars on the hill View All Ads Member Since:October 2012 Location:Oliver, British Columbia Email Seller More ads from cars on the hill Year 1983 Make Dodge Model van Mileage (Km) 130000.00 Post Date:Oct 22, 2025 Exp. Date:Nov 21, 2025 Listing Type:Private Ad Number:5205166 Login to Add to Watchlist Important Safety Tip If you feel that this ad is miscategorized, fraud, scam or phishing, duplicate or business listing report it by clicking here. More Like This 1980 Chevy 4x4 Van 1980 Chevy van placed on 1978 K-5 Baze chassis with 400ci small block motor lots of extras makes a great 4x4 for camping, hunting or whatever you like.. Rare VW 1990 Vanagon Hightop For Sa I bought this Vanagon hightop in 2020 and have really loved it, but I don't have time to do what I want to it, so I’ve made the difficult decision t.. 2009 Ford E-150 Econoline Low KM, E-150 Cargo Van Transmission: Automatic KMs: 166690 Exterior Colour: White Stock #: 4212 VIN#: 1FTNE14W99DA78861 Low Km 2009 Ford E-150 Econoline .. 2006 ford e250 contractor van 2006 ford e250 contractor van. Low km 214,xxx for year. 3/4 ton. 4.6L V8 power windows, locks, cruise, tilt, A/C. Tow hitch. Everything works, r..

Citigroup CEO Jane Fraser was elected as chair of the board of directors, the bank said in a filing on Wednesday. Fraser replaces John Dugan, who has been chair since 2019 and will now become lead independent director. The board also granted a one-time equity award of $25 million that will vest fully within five years, to ensure “leadership continuity,” according to the filing. The board says Citi’s recent performance improvement “is directly tied to Fraser’s track record as CEO” and cites as accomplishments the international business divestitures, hiring new executives, simplifying the bank’s structure and making progress on regulatory issues. Fraser’s new dual role as CEO and board chair is similar to the ones held by Jamie Dimon at JPMorgan Chase and Ted Pick at Morgan Stanley. She became Citi’s CEO in 2021. In a statement, Dugan said “Citi is in a fundamentally different place than it was when these roles were separated.” Fraser said in a statement the bank has shown it can grow returns to shareholders.

Adam Silver isn’t easing into the new NBA season. He’s walking straight into the fire with a calm face and a full agenda. The commissioner’s 12th year on the job begins with everything from broadcast shakeups to betting controversies and expansion debates. But if there’s one constant, it’s that Silver never avoids tough conversations. As he told Sports Illustrated and TODAY, the league’s challenges, from streaming confusion to team investigations, are all part of the job. “We will get to the bottom of it,” he said about the Clippers’ salary cap probe, SI reports. That line sums up his approach perfectly: deliberate, transparent, and built on trust. 1. Silver Still Believes in Transparency When the Clippers and owner Steve Ballmer were linked to an alleged cap circumvention scheme, Silver didn’t flinch. He immediately handed the case to one of the league’s most trusted law firms, showing that even the wealthiest owners are not beyond scrutiny. He compared the process to a court of law, with evidence coming before judgment. In Silver’s NBA, credibility is the real currency. He knows the stakes are high. A scandal tied to one of the league’s marquee owners could shake public trust, but Silver’s focus remains on patience over panic. Protecting the league’s integrity is not about appearances, it’s about doing the work quietly and letting the truth surface. 2. The Broadcast Revolution Will Be Bumpy but Worth It The new $77 billion national TV deal may have fans scrambling for remotes, but Silver sees a bigger picture. The NBA’s move to NBC, Prime Video, and ESPN’s app means short-term disruption and long-term flexibility. “Technology is clearly our friend here,” Silver said, showing his belief that digital access will eventually win out. Charles Barkley and other critics may see the new deal as anti-fan, but Silver is betting on the next generation of viewers who watch basketball through apps, phones, and social platforms. It’s the commissioner’s boldest media move yet, redefining what accessibility means in a streaming-first era. 3. The Regional Sports Network Crisis Is Silver’s Next Big Test The collapse of regional networks has threatened one of the NBA’s most reliable revenue sources. Silver’s calm, analytical response reveals how he views change as an opportunity, not a disaster. He noted that local games have “twice the engagement” of national ones, a crucial statistic that proves fans crave connection to their home markets. For Silver, the answer lies in streaming’s inevitable rise. As traditional television declines, he expects major platforms to compete for those valuable local audiences. It’s a bet on the future that blends technology, adaptability, and business sense. 4. Sports Betting Still Walks a Tightrope Gambling is now a part of modern sports, but Silver remains cautious about how deep that integration should go. Prop bets, especially on fringe players, create uncomfortable gray areas. Silver admits he can’t control every state or operator, yet he’s pushing for “reasonable modifications” to protect player integrity and the league’s reputation. He understands that betting keeps fans engaged, but it’s a delicate balance between innovation and restraint. The NBA under Silver is still a business, but one that operates with a clear moral compass. 5. Expansion Isn’t Gone, It’s Just Getting Smarter Fans have been asking for expansion in cities like Seattle, Las Vegas, and Mexico City. Silver refuses to rush it. His reasoning is mathematical, not emotional. The league is still modeling the financial impact to ensure expansion strengthens the NBA instead of diluting its value. At the same time, Silver is exploring an NBA-style league in Europe with help from JPMorgan and the Raine Group. It’s the global version of his long game. He plants seeds early and moves only when the conditions are right. His restraint shows why he’s often compared to a strategic CEO rather than a reactive commissioner. 6. Silver’s Influence Extends Beyond the NBA Silver’s vision for basketball reaches far beyond the men’s game. On The TODAY Show, he confirmed that WNBA players will receive a “big increase” in salaries under their new collective bargaining agreement, per BET. He emphasized “absolute numbers” rather than percentages, signaling that sustainable growth matters more than optics. It’s more than good publicity. The NBA owns 42 percent of the WNBA, meaning Silver’s leadership directly impacts the women’s game. As women’s basketball continues its surge in popularity, his direction ensures it is seen as part of the same basketball family, not as an afterthought. Silver’s confidence is quiet but unmistakable. He speaks like someone who understands that the league is evolving faster than ever and that fans, players, and owners need to keep up. Whether it’s navigating streaming wars, guarding the game’s integrity, or building basketball’s global future, Adam Silver continues to prove that leadership in the NBA is about both vision and vigilance. The ball is up, and the commissioner is already a step ahead.

There’s plenty to talk about when it comes to this Knicks squad. There are the high expectations — NBA Finals or bust, anyone? — a new coach in Mike Brown, who has revamped the offense and rotation, the injury statuses of Mitchell Robinson, Josh Hart and now Karl-Anthony Towns, and plenty more. And that’s before the opener even tips off. No doubt, beginning against longtime nemesis Donovan Mitchell and the Cavaliers, last year’s top-seeded Eastern Conference team, will heap even more early season discussion points. Join Dexter Henry, Bryan Fonseca and DJ Ria for The Post’s live Knicks party, including special pregame coverage featuring Knicks beat writer Stefan Bondy.

Arne Slot admitted Liverpool did not get the balance right with Alexander Isak’s fitness after he went off injured against Eintracht Frankfurt

Trump says he canceled meeting with Putin because ‘we have good conversations but then they don’t go anywhere’

Annabel Sutherland floored England in Match 23 of the ICC Women's World Cup 2025 on Wednesday. The match in Indore saw Sutherland and Ashleigh Gardner added an unbeaten 180-run stand for the 5th wicket in a chase of 245. Sutherland remained unscathed on 98* whereas Gardner got to a terrific 104 not out. Earlier, Sutherland picked a three-fer to restrict England to 244/9. This was one of the finest partnerships in Women's World Cup history. Sutherland saw Gardner join her and the two just bossed the show. Sutherland looked set for her 100 till a late charge from Gardner saw her overtake the former. England were stunned and had no answers to a superb 180*-run stand which came off just 148 balls. This was a special partnership. Sutherland's knock of 98* had 9 fours and a six. She faced 112 balls. With this knock, Sutherland has raced to 968 runs in WODIs. She averages 42.08 from 47 matches (31 innings). This was her 4th WODI fifty (100s: 3). As per ESPNcricinfo, against England, Sutherland owns 199 runs from 10 matches at 33.16 (50s: 2). Sutherland registered her maiden World Cup fifty. Speaking after the match, Sutherland said it was fun batting with Gardner. Pretty fun. Always good batting with Ash. She keeps the game moving. Had a pretty good seat at the other end. Oh, to be honest, just trying to have some time in the middle. I feel like once you got in, it was actually really nice wicket to bat on.

Russian dictator Vladimir Putin supervised what he said was a planned test of Russia’s nuclear forces on land, sea and in the air to assess his nation’s readiness on Wednesday. “Today, we are conducting a planned — I want to emphasize, planned — nuclear forces command and control exercise,” Putin said in a video conference with the Kremlin’s top military brass, CNN reported. As part of the test, a land-based “Yars” intercontinental ballistic missile was launched from a cosmodrome while a “Sineva” ballistic missile was launched from a nuclear submarine in the Barents Sea. Russia also deployed nuclear-capable cruise missiles from strategic bombers. Moscow typically carries out nuclear drills to rehearse its command structure and flex the world’s largest nuclear arsenal to its adversaries — and Wednesday’s came one day after President Trump revealed he nixed a second in-person summit with Putin over his war in Ukraine. “The exercise tested the level of preparedness of the military command and the practical skills of the operational personnel in organizing the control of subordinate forces,” the Kremlin said in a statement. “All exercise tasks were completed”. The readiness test comes on the heels of NATO conducting nuclear exercises earlier this month, dispatching F-35 fighter jets and B-52 bombers in a horde of more than 70 aircraft from 14 allied nations for its Steadfast Noon exercise in Belgium and the Netherlands. “We need to do this because it helps us to make sure that our nuclear deterrent remains as credible, and as safe, and as secure, and as effective as possible,” NATO Secretary-General Mark Rutte previously said in a video statement. The drill comes as Putin claimed last month that he is amenable to a one-year extension of the arms control treaty with the US that limits the number of nuclear weapons the two countries have in their arsenals. He said he would back an extension of the New Strategic Arms Reduction Treaty, or New START, if President Trump agrees to it as well. The overture comes as New START, which limits the nukes each side can deploy, is set to expire on Feb. 5, 2026. The New START was signed by former President Barack Obama and his then-Russian counterpart Dmitri Medvedev, limiting the two countries to 1,550 deployed warheads as well as 800 launchers and bombers. With Post wires

In this year’s neck-and-neck race for governor, New Jerseyans are demanding change. They deserve it. Democrats have been the majority party in both chambers of the Legislature for about a quarter of a century and have held the executive branch for eight years. Judges are appointed by the governor and confirmed by the state Senate, so the Democratic Party has effectively controlled the judiciary, too. Under their dominance, taxes have soared out of control, urban schools are failing and electricity costs are sky-high. Plus, many of the state’s policies clash with the cultural values of large swaths of Jersey citizens. Jerseyans are suffering, big-time. Of the two candidates in this year’s governor’s race, Republican former Assemblyman Jack Ciattarelli is promising change; his progressive rival, Democratic Rep. Mikie Sherrill, is attached at the hip to the status quo. And four issues — taxes, schools, energy costs and cultural values — are at the heart of the contest. Start with energy: Under Democratic Gov. Phil Murphy, six of New Jersey’s large electric generation facilities, some nuclear and some natural gas, have been decommissioned or gone offline. New Jersey, which once sold excess power to the regional grid, now must buy it at spot-market prices from nearby states. Murphy bet big on solar and wind power to appease radical greens — but failed to gin up nearly enough energy to satisfy statewide demand. That left Garden Staters short, and sent electric bills soaring. Ciattarelli aims to back out of the Regional Greenhouse Gas Initiative so the state can build more natural-gas plants, boosting electricity supply and bringing down costs. He and his fellow Republicans also plan to reform the state’s permitting process so power lines and natural-gas or nuclear plants can be built faster. That would be a godsend. In contrast, Sherrill backs pricey, environmentally unfriendly wind turbines, which have failed to materialize and can’t generate enough of the power we need. Don Quixote’s got nothing on her and her fellow Dems. New Jersey also has the highest property taxes in the nation, per the Tax Foundation, and the highest corporate income tax. Ciattarelli has pledged to chop the corporate rate by one percentage point a year for six years; Sherrill vows to close loopholes, making businesses pay even more. She’s clearly out of touch: Other states’ corporate tax rates, like North Carolina’s, are as low as 2¼%. You can bet jobs (and the tax base) will continue to flee New Jersey if she takes the reins. Sherrill would also continue the Affordable New Jersey Communities for Renters and Homeowners program, which issues state rebates to those who pay property tax or rent. That might sound good on the surface, but the rebates themselves are small — and more important, they simply shift governmental costs around, solving nothing. In contrast, Ciatarrelli wants to impose a statewide cap on property taxes, forcing municipalities, counties and school boards to make difficult but necessary fiscal decisions — and saving homeowners thousands every year. New Jersey spends more per student than nearly any other state in the union, yet the quality of schools in our 600-plus districts varies greatly. Ciattarelli would place renewed focus on phonics to improve reading, and would boost choices for parents by expanding charter schools, especially in areas where districts are underperforming. He’d reform the school-funding system, so that state money follows the students. Sherrill would limit parent’s choices and put the interests of the powerful teachers’ union ahead of both children andteachers. On cultural issues, Ciattarelli argues strongly that biological males should not be allowed to compete in women’s sports, which is both unfair and dangerous to women. That view, an American Principles Project poll found, matches those of 68% of Garden Staters — just 22% of whom back transgender kids in girls’ sports, which Sherrill supports. Caittarelli would also respect federal law and the US Constitution by cooperating with immigration authorities’ enforcement efforts. He plans to end sanctuary status for the state, along with its counties, cities and towns. Sherrill supports sanctuary status and would flout her constitutional duty to work with the feds. Indeed, as a dyed-in-the-wool progressive, a Gov. Sherrill would impose more of the same punishment Murphy has inflicted on New Jersey residents for the past eight miserable years. Ciattarelli would bring the kind of change Garden Staters crave: affordable electric bills, relief from crushing taxes, more options for education and an end to crazy, harmful far-left cultural policies. Voters who see the clear differences should have an easy choice. Adam Kraemer, a Republican, is running for the District 27 seat in New Jersey’s General Assembly.

Sonic the Hedgehog has had a great run of video games and live-action movies recently, but some of the Blue Blur's best adventures can be found in IDW Publishing's long-running comic book series. Sonic, Tails, Knuckles, and many other characters from Sega's iconic franchise have starred in over 100 issues since 2018, and you can get dozens of them for cheap right now. The premium Sonic the Hedgehog IDW Collection hardcovers are steeply discounted, and Volumes 1-4 are eligible for Amazon's Buy Two Get One 50% Off Book Sale. Each Sonic the Hedgehog: The IDW Collection hardcover retails for $60, but if you buy two, you'll wind up paying approximately $25 per book. This is quite the bargain, as each collection includes around 300 pages of full-color comics. Sonic the Hedgehog trade paperbacksSonic the Hedgehog by IDW PublishingOnly the first three trade paperback volumes have been collected in a box set, but IDW has published 19 volumes since 2018. Volume 20 speeds into bookstores December 2. Sonic the Hedgehog Vol. 1 -- $13 ($16)Sonic the Hedgehog Vol. 2 -- $14 ($16)Sonic the Hedgehog Vol. 3 -- $13 ($16)Sonic the Hedgehog Vol. 4 -- $14.87 ($16)Sonic the Hedgehog Vol. 5 -- $14.84 ($16)Sonic the Hedgehog Vol. 6 -- $12.60 ($16)Sonic the Hedgehog Vol. 7 -- $14.87 ($16)Sonic the Hedgehog Vol. 8 -- $14.87 ($16)Sonic the Hedgehog Vol. 9 -- $12.60 ($16)Sonic the Hedgehog Vol. 10 -- $11 ($16)Sonic the Hedgehog Vol. 11 -- $10.62 ($16)Sonic the Hedgehog Vol. 12 -- $14.67 ($16)Sonic the Hedgehog Vol. 13 -- $13 ($17)Sonic the Hedgehog Vol. 14 -- $13.50 ($17)Sonic the Hedgehog Vol. 15 -- $15.80 ($17)Sonic the Hedgehog Vol. 16 -- $15.80 ($17)Sonic the Hedgehog Vol. 17 -- $12.88 ($17)Sonic the Hedgehog Vol. 18 -- $14 ($17)Sonic the Hedgehog Vol. 19 -- $15 ($17)Sonic the Hedgehog Vol. 20 -- $15.80 ($17) | Releases December 2 See Volumes 1-20 at Amazon The numbered volumes are printed in chronological order, but IDW also has an assortment of standalone miniseries, greatest hits, and collections themed around specific characters. All of the books in the list below are paperback editions, too. Sonic the Hedgehog: Scrapnik Island -- $14.87 ($16)Sonic the Hedgehog: Imposter Syndrome -- $10.40 ($16)Sonic the Hedgehog: Knuckles' Greatest Hits -- $7.50 ($10)Sonic the Hedgehog: Seasons of Chaos -- $10 ($16)Sonic the Hedgehog: Sonic and Tails - Best Buds Forever -- $8Sonic the Hedgehog: Tangle and Whisper -- $16 ($20) More Sonic the Hedgehog BooksSonic the Hedgehog Encyclo-speed-ia and IDW Comic Art Collection Sonic fans should also check out the official Encyclo-speed-ia, a massive collection of artwork and commentary celebrating three decades of Sonic video games. A Deluxe Edition is available as well. Sonic the Hedgehog Encyclo-speed-ia offers a fascinating look behind the scenes of the development of the games, from their humble Genesis days through to new platforms over the decades. Sonic the Hedgehog 30th Anniversary Celebration: Deluxe Edition -- $14.40 ($20)Sonic the Hedgehog Encyclo-speed-ia -- $26.64 ($50)Sonic the Hedgehog Encyclo-speed-ia Deluxe Edition -- $45.86 ($80)Sonic the Hedgehog: The IDW Comic Art Collection -- $12.69 ($20)Sonic the Hedgehog: The IDW Covers -- $50 See more Sonic books

In this podcast, Motley Fool co-founder and CEO Tom Gardner, Motley Fool Chief Investment Officer Andy Cross, and contributor Toby Bordelon talk with DocuSign CEO Allan Thygesen about opportunity, innovation, and the business of DocuSign. To catch full episodes of all The Motley Fool's free podcasts, check out our podcast center. When you're ready to invest, check out this top 10 list of stocks to buy. A full transcript is below. This podcast was recorded on Oct. 12, 2025. Alan Thygesen: I've worked for 40 years. The pace of change right now in every aspect in our product innovation in our go-to-market, in our packaging and pricing, we just discussed in how we market, how people discover us. I mean, all of that is just changing at a rate that is exhausting and exhilarating at the same time. Mac Greer: That was DocuSign CEO Alan Thygesen. I'm Motley Fool producer Mac Greer. Now, DocuSign provides e-signature solutions and other contract management tools. We recently had a chance to talk with Alan Thygesen about opportunity, innovation, and the business of DocuSign. Tom Gardner: Hello, fools. Tom Gardner here with our Chief Investment Officer, Andy Cross and Toby Bordeloon, and we're so excited to be able to spend this time with the CEO of DocuSign, a Molly Fool recommendation, ticker symbol DOCU, and the CEO is Alan Thygesen and Alan, thank you so much for being here with us today. Alan Thygesen: It's a pleasure to be with you, Tom. Thanks. Tom Gardner: Of course, this is a standard opening question for you that everybody thinks historically of DocuSign as a signature company. Let's talk about all that it does now with AI workflows and just get right into it in terms of the end-to-end workflow opportunities of the company. Alan Thygesen: Fantastic. Yes. Well, I'm sure many of the listeners have signed with DocuSign over the years, either in a personal or professional context. Look, that's an amazing starting point. We are involved in the perhaps, most important moment of the journey that an agreement goes through. That was part of what attracted me to the company three years ago was that position and affinity. But as you said, there's a lot more to agreements than the execution moment. DocuSign had that general idea for a while that we could go upstream from people executing documents to mass customizing documents, maybe to identifying the parties, and so on. But we've never really put it together end-to-end in an agreement management suite. That's what we've done. We launched that in June of last year. Literally every stage of the agreement journey from creating the agreement, negotiating it, managing all the internal approvals, pre-filling the agreements, executing them, and then managing them once they're executed and figuring out what you might want to renegotiate or figuring out how you're doing in your contracts or where you have exposure. All of that is available. Much of it AI-enabled, which I'm sure we'll get into. We call it intelligent agreement management, and it's been fun. It's been a revitalization of the company. I think we've rediscovered our innovation Mojo and benefiting from, as I said, at the beginning, from already being a trusted partner with the signing product. That's a nice starting point. Tom Gardner: Two follow-ups for me and then I'll let the real great interviewers get in the mix. When you reenergize a company in terms of awakening its desire to innovate, what are the top two or three things that you think are essential to that transformation, the process of getting those muscles working again? Alan Thygesen: The first thing is, look, you have to have the right leaders and so I attracted some great folks that combined with some of the amazing talent we had here could be leading that effort. I think we had to articulate a compelling vision, a mission that felt worthwhile and that honored what we had done before, but represented the opportunity, and sometimes it's better to be lucky than good. I joined in October '22, and GPT 3.5 launched a month later and I had some idea what was going to happen with AI, but obviously that's worked out incredibly well for us. Then lastly, I think you got to set some immediate goals that allows people to feel like they can be successful. We set this goal of launching the first part of the suite and in particular launching our intelligent repository. Basically, a place to store all your agreements that uses AI to extract all the essential data out of them. We agreed on that in August of '22, and we launched a Beta by the end of January the following year. I don't think anybody in product engineering thought that that was possible or good idea. I think once we did it, it was such a can-do moment for the company and it was so exciting. It became the heart of our launch, and then we relaunched the company in a big way and gradually got all the teams involved through the sales and support teams. I think the whole company has rallied around that mission and a sense that the transformation is now possible. The other chic had a bold vision, but you also got to show them how they can get there and having those early proof points was super important. Tom Gardner: I'm going from the forest level right down to the pine cone with this follow-up in a very unprofessional interview format. But how is the suite priced now? What has changed in pricing with the addition of all these features? Alan Thygesen: You'll not be surprised to hear that it's gotten more complicated. I mean, historically, the way DocuSign has been priced is we sell our electronic signature product in a batches of envelopes basis. The envelope is basically a collection of documents that are sent for signing. That was a good proxy for value. Didn't capture how important the document was, but it was a nice simple model that everybody could understand and that allowed us to scale up. Well, that obviously doesn't work anymore, given that we're now doing this much broader range of workflows that's not necessarily related to agreement volume and the value depends on which parts of the suite that you use and maybe how large your library is. We've evolved because you got to keep it simple enough that we sell to companies of all sizes. We're not just enterprise company. We sell to 100-person companies, even to two-person real estate offices and everywhere in between, so it needed to be simple to start, so we used a seat-bat model with some thresholds for the size of your library. Now we're rolling out more complicated or complex model that is a platform plus various features that can turn on and where we attempt to capture some sense of the value that we're delivering and that the customer would feel good about paying for. But to be honest with you, it's evolving as we speak, because all these AI features, what you really want is to align your pricing with the value that you deliver. It's just so hard to find those proxymetric that are objective and that you and the customer can agree on and then it has to be simple enough that they can understand it going in and that we can explain it to them in a relatively short conversation. I don't think we've nailed that yet, but we're getting there. But we started with something relatively simple with c+ and then we're evolving toward more platform pricing with tokens for different types of value. Tom Gardner: It's never really felt great as an analogy going to you, Andy, but we're building the plane as we fly it. We've all heard it before. Maybe we don't want to actually visualize that. That probably doesn't feel great. But with the tooling, all the new tooling, all the upgrades, you have to be able to keep transforming yourself, and that means the value you're creating is going to shift, and it's going to be a fluid environment. Alan Thygesen: I've worked for 40 years. The pace of change right now in every aspect in our product innovation, in our go-to-market, in our packaging and pricing, we just discussed and how we market and how people discover us. I mean, all of that is just changing at a rate that is exhausting and exhilarating at the same time. Andy Cross: I want to have a follow-up on that because you talked about some of the sales restructuring and reorganization. We've been hearing this from a lot of different software companies. I think this is part of this conversation about things moving so fast and being able to articulate your value prop. Talk a little bit about what encouraged you to change or what forced you maybe to rethink the sales organization and what change did you actually implement throughout the year? Alan Thygesen: I think to start, DocuSign was historically a direct sales company, and to a fairly extreme extent. I mentioned earlier how we have customers of all sizes. Unless you were buying the absolute most simple bundle we offered, you were basically told to talk to a seller. We had sellers that had hundreds of accounts, sellers that had a smaller number of larger accounts. But basically, everybody was assigned to a salesperson. Eighty five percent of the company's revenue was managed by the direct sales team. When I came in, my first observation was, wait a minute. We're a digital contracting product. You should be able to digitally transact with us in a more robust way. We worked on that and made a lot of progress on that. Now you can order all the products and upgrade as you see fit. But the second part is, as our product roadmap changed from this point solution that everybody understood well and that many people were able to implement by themselves without any external help to this broader agreement management solution, what we needed both on the sales front and on the post sale side changed, because we're now selling a solution, a platform that others can even add on top of, that's just very different kettle of fish. We've been doing a lot of enablement, which is a fancy word for training your sales team, as well as upgrading and select places to get people who are more familiar with that motion. We're leaning much more heavily on partners now. Historically, there wasn't a need for a partner to be involved in selling signing, but with this new platform, we need the delots to the world and their counterparts regionally and in specific industries to do more work with us. They're very interested, but we have to learn to dance with them and do a better job of that. Those are some of the changes on the sales side. Then the support side, of course, again, sign was a simple, singular product, and it was a fairly transactional support model. People would call or email it's a problem and we could usually solve it over the phone. That way. Now it's a much richer processes. You got to consult with people on how to use the AI, how to get their data in the right place, and how they might want to change their workflows. Those are all more robust things. Some of those are things that a classic enterprise software brand that would have done before and some of it is specific to AI. This notion of building models with customers that didn't really happen before. That's new. Tom Gardner: Let's randomly leap forward 12 years and ask ourselves, has DocuSign replaced law firms? Have we moved beyond just the management of the actual workflow to a lot of the negotiation? The whole process of coming to agreement can be automated. Alan Thygesen: No, I don't think so. Let me say a couple of things. First of all, I think you will absolutely see automation of some lower-level legal work activity today. Things like you could imagine an automated negotiation of an NDA. I don't think that's super futuristic. I think that's mostly possible with tech today and since there's not that much risk in most cases, I think we'll see some of that. You can imagine agent-type onboarding of new vendors and new clients. But I think that's not really, I think, why people retain law firms. Yes, they do do some of that work today, and so some of that work will go away. But the reality is that legal is one of the most under-resourced functions in any company. It's one of the reasons why everybody always complains that legal is a bottleneck. There's so much headroom, I think, to take those repetitive but manual tasks and automate them. I think on the more complex judgment where there's meaningful amount of risk involved. Sure, the AI will do a lot of pre-processing and will serve it up to humans, but you'll still have human review for an extended period of time, no opinion. Now, I think it's very scary to try to forecast what's happening in 12 years. That was your time frame? Tom Gardner: You meant 12 months. If we had said 12 years, how long time is that 1995? Obviously, we know the pace has picked up so much. It's really interesting to think how planning happens. Your answer to that suggests that my second question, which is more of an idea, I wanted to play out and have you shoot it down. You've already shot it down. But would we ever think about renaming our company from DocuSign to Docu Flow? Alan Thygesen: We had that discussion because we went through a significant rebranding exercise holistically, not just about the name, but about our look and feel and what we were trying to communicate about the brand when we were getting ready to launch Intelligen review and management. I said to the team, look, I was willing to consider anything but change in the name. Look, if you've got a name like ours that's instantly recognizable and has very positive generally affinity, I think the bar is incredibly high to mess with that. We have over 1.5 billion individual profiles that have executed the document, the DocuSign. We have over 1.7 million monthly paying customers that pay us for our services. I mean, those are very large numbers. I can't even imagine the media plan and the effort that it would take to meaningfully substitute that if you tried to change the name. Yes, I did have people who suggested that, and of course, it does tie us back to sign, but-. Tom Gardner: They and I were dismissed from your company. Alan Thygesen: I'm sorry, but I don't think that would be a good idea. Andy Cross: You've been focused on bottoms-up, innovating. You've been talking about this, you've done that. Talk to us a little bit about the product development, the innovation, engine if you maybe peel back the curtain a little bit for us at DocuSign without getting too much into the weeds. But just curious how you think about motivation, your team, and just the release schedule, how quickly you trying to innovate these days. Alan Thygesen: DocuSign was COVID darling, where we were growing very nicely before COVID and then we have all this demand pull forward from COVID. Then when that receded, it was a hard reset. Some use cases fell away and customers had pre-bought and bought more than they needed. It was pretty tough reset, and that affected all parts of the company. Think one of the things that's a hidden cost of that automatic demand is that it's not just your salespeople who fall asleep and forget how to sell your product engineering organization. Well, as long as I keep the lights on, I can do what I want. I think we lost some DNA. It wasn't as much of a focus on shipping and moving the needle from innovation perspective. As we discussed earlier, I think we setting the bar, articulating a new vision, explain to people that they were empowered to go and innovate and suggest ideas, raising expectations on release velocity. We were doing a couple of releases a year, and now we're shipping much more frequently. All those things are little things that you do. You give people better tools to get their work done faster. All those things have helped speed up productivity. We're in a much better place. I still would like to move faster. I'm impatient by nature, and I think particularly in today's environment, you need to be impatient. You can't be looking at yourself or how you are doing compared to how you were doing 2-3 years ago. You got to be looking at how fast are the cutting-edge companies going, and they are going very fast. Tom Gardner: Do you see any threats on the AI front in terms of being a threat to your business, allowing competitors perhaps to come in and more easily compete with what you're doing? Alan Thygesen: Let me put it this way. I think what it unlocks for us and for the category is such a massive leap forward. For historic documents, agreements have been done flat files. They might as well have been in a physical filing cabinet. Everybody had this PDF stored somewhere, if they could even find it, and I didn't know what was in it and they had no tools for managing that. AI really transforms that. That's an unlock not just for us but for everybody, but then the fact that we start in this position of having all this understanding of agreement structure and being involved in so many steps of agreement workflow and having the distribution to all these companies. Look, you got to worry, as we talked about earlier, about some smart start of coming up with some killer functionality that you hadn't thought of or can't replicate, but I feel it's been a blessing and just a giant opportunity for us and I'm just very fortunate to be leading DocuSign this time. Tom Gardner: Alan Thygesen, CEO of DocuSign, thank you for spending time with us. We enjoyed every minute of it. Obviously, we've been following DocuSign since its IPO, all the way through and so excited about what you're creating there with your team and all DocuSigners. Are we DocuSigners when we come to work? Toby Bordeloon: We are. Tom Gardner: We're DocuSigners. In the way that Jensen Wong is working to bring us new technologies, you're working to bring us investment returns, and we thank you just as much as we thank Jensen. Thank you for the time and best of luck. Toby Bordeloon: Thank you. It was really great to chat with you guys. We should have. Mac Greer: As always, people on the program may have interest in the stocks they talk about and the Motley Fool may have formal recommendations for or against, don't buy or sell stocks based solely on what you hear. All personal finance content follows Motley Fool editorial standards and is not approved by advertisers. Advertisements are sponsored content and provided for informational purposes only. To see our full advertising disclosure, please check out our show notes. For the Motley Fool Money team, I'm Mac Greer. Thanks for listening, and we will see you tomorrow.

Prince Albert’s tabletop community is trading capes and cards this month as Tramp’s Music & Books prepares for two Halloween-themed events that blend Magic: The Gathering play with family-friendly fun. On Oct. 25, the store will hold a special Halloween-themed Magic: The Gathering draft. Players will build decks from cards they draft on the spot, competing for booster packs and promo cards. Assistant manager Alice Read said the evening will feel more relaxed than a standard tournament but just as exciting. Costumes are encouraged, and she expects to see a mix of veterans and newcomers taking part. “It’s just about having fun,” Read said. “We’ll have people come dressed up, and some will bring friends who haven’t played before. It’s a really good way to keep the community engaged and keep things lighthearted.” The Halloween draft is open to players aged 12 and up, though younger players who know the basics are welcome to join. Read said events like these often draw players who might otherwise feel intimidated by the competitive side of the game. A few days later, on Oct 31, Tramp’s will welcome trick-or-treaters with free comics and Pokemon cards as part of its annual “Trick or Read” giveaway. The store will hand out Halloween-themed comic books such as Godzilla and the Fantastic Four, along with small “Trick or Trade” Pokemon booster packs while supplies last. “It started last year, and it’s growing,” Read said. “Families come by in costume, and it’s just a nice way to give something back and get kids reading, or collecting something fun.” The store will also host its regular Friday Night Magic on Halloween night, with costumes encouraged and small prizes for those who show up in theme. The atmosphere, Read added, is meant to be playful and welcoming rather than competitive. Since the Spider-Man prerelease in September, the store has seen an increase in young adults and families interested in Magic and comics. Read said the draw isn’t just the game itself but the sense of belonging that comes with it. “Whatever the theme is, it’s about hanging out with a good crowd,” she said. “It gives people somewhere positive to go, a healthy community to be part of.” Tramp’s Music & Books is located at 29 12th Street West. The Halloween draft begins at 1 p.m. on Oct. 25, and the “Trick or Read” giveaway runs on Oct. 31 during store hours and throughout the evening.

Jamie Lynn Spears has reportedly unfollowed Kevin Federline on Instagram after he published her alleged texts slamming her sister, Britney Spears, in his new memoir. The “Zoey 101” alum unfollowed the former backup dancer as well as his wife, Victoria Prince, Us Weekly reported. Both Jamie Lynn’s rep and Federline’s rep didn’t immediately respond to Page Six’s request for comment. In Federline’s memoir, “You Thought You Knew,” he published texts he claimed Jamie Lynn sent to Prince calling Britney an absentee parent to her and Federline’s sons: Sean Preston, 20, and Jayden James, 19. “I always wanted her to get better, especially for the boys,” Jamie Lynn allegedly wrote about her older sister, according to Federline. “I’m still trying to come to terms with how she could be so unaware of anything outside of herself,” she continued, per the memoir. The former Nickelodeon star, 34, also allegedly said Britney was“incapable” of taking “accountability” and praised Federline and Prince for raising Preston and Jayden. “I’m sure my sister has never thanked y’all for raising her children and still being beyond gracious to allow her so many chances to take part in their lives, even when y’all had more than enough reasons to validate cutting that off,” she wrote, according to the memoir. “So I wanted y’all to know how much you are appreciated and supported by those of us who love those boys.” Federline accused Britney of mistreating their sons on multiple occasions in his memoir, including alleging that she once punched Preston in the face and told him that she wished him and Jayden were dead. Britney has blasted her ex-husband for “making profit [off] her pain,” which her spokesperson also previously told Page Six. “He and others are profiting off her,” the spokesperson told us regarding Federline’s book. “Sadly, it comes after child support has ended with Kevin. All she cares about are her kids … and their well-being during this sensationalism.” Federline, 47, told “Extra” that Preston and Jayden supported him writing the bombshell memoir ripping the iconic pop star, 43. “My kids are old enough to understand and approve what I’m doing,” he said, defending his book. “I don’t want my kids living their lives and having to explain who I am,” he continued. “I say that in the book — I don’t want them talking about things that they didn’t live through or can’t remember.”

MY ACCOUNT SUBSCRIBE ADVERTISE JOBS FAQ PRIVACY POLICY EDITORIAL POLICY CONTACT US ABOUT YARDBARKER TERMS OF SERVICE Copyright 2025 YB Media, LLC. All rights reserved. Use of this website (including any and all parts and components) constitutes your acceptance of these Terms of Service and Privacy Policy. This site is for entertainment purposes only.There is no gambling offered on this site. Gambling Problem? Call 1-800-Gambler.

Todd Armstrong, the owner of a 200-year-old family cattle and crops farm in Indiana, voted for President Donald Trump in 2024 but feels abandoned by the president now for suggesting a deal for the US to buy beef from Argentina.

Fide faces calls to discipline Vladimir Kramnik after his public attacks on Daniel Naroditsky, whose death has shaken the online chess community